KUALA LUMPUR Aug 2. Full EPF settlement EPF partial withdrawal or pension withdrawal.

Epf Announces Terms For I Sinar Withdrawal

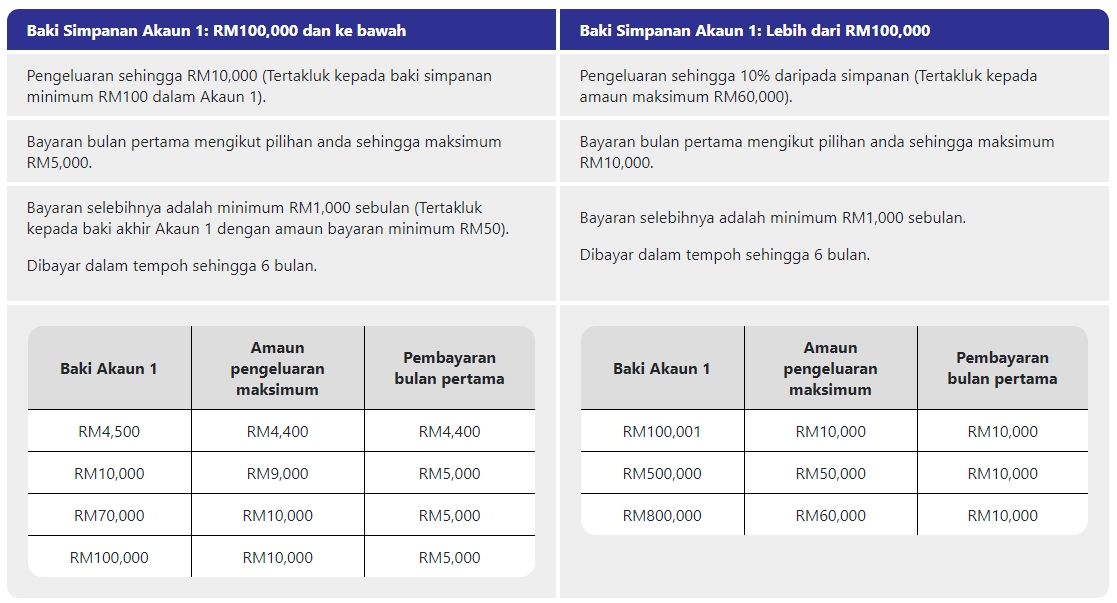

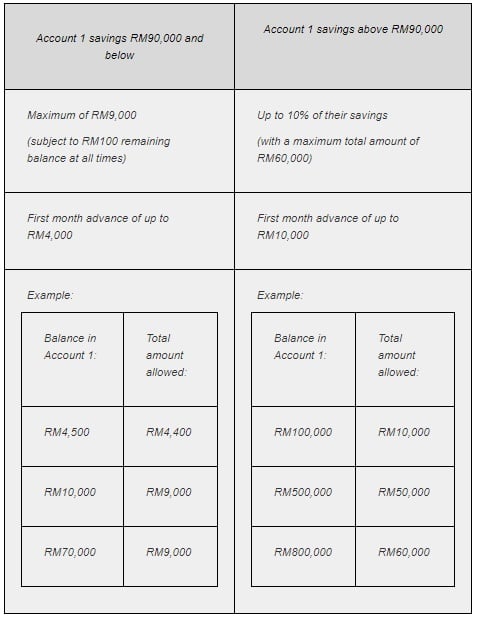

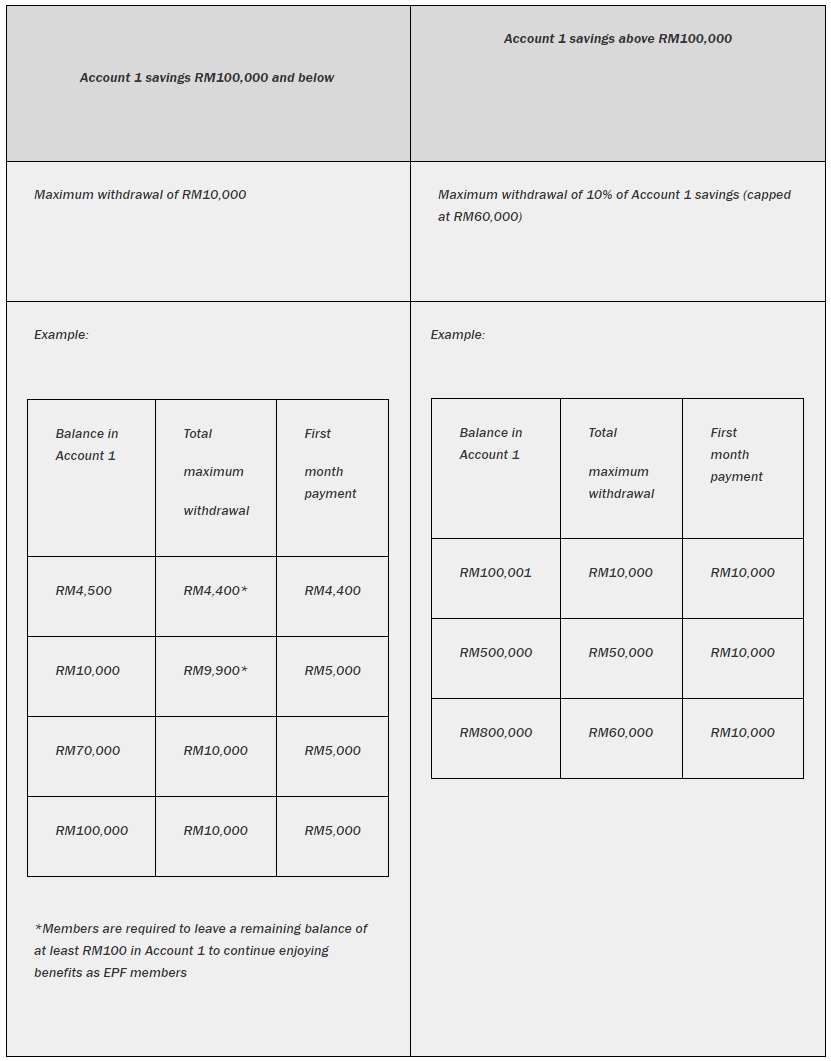

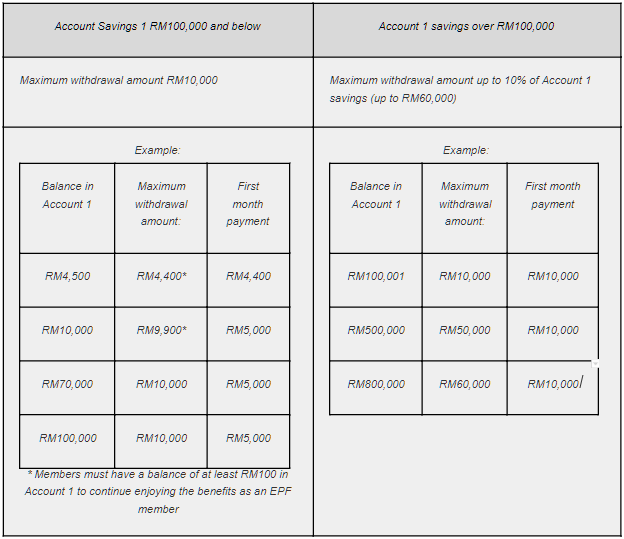

However the maximum total amount withdrawal allowed is RM60000.

. Then click on the Proceed for Online Claim option. It is an extension of the previous i-Lestari Account 2 withdrawal programme that ends in March 2021. 3 rows a.

The unconditional withdrawals under the Employees Provident Funds EPF i-Sinar facility is expected to provide an immediate positive impact to the economy in terms of consumption said Bank Negara Malaysia BNM deputy governor Datuk Abdul Rasheed Ghaffour. The liquidation of assets carried out by the Employees Provident Fund EPF remains based on the ordinary course of business of the EPF itself without any specific liquidation to cover the withdrawals under the i-Lestari i-Sinar and i-Citra schemes as well as the special one-off withdrawal of RM10000. If you want to know what else you can do with your EPF monies read.

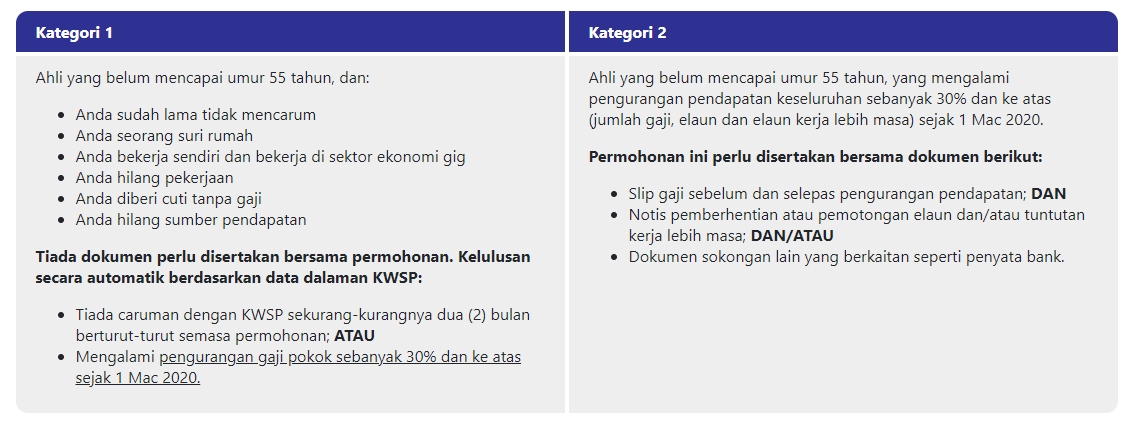

According to reports i-Sinar allows EPF members to withdraw funds from Account 1 that is usually only accessible once members turn 55 years old. Category 1 members have been able to submit their applications since Dec 1 2020 while members under Category 2 can start applying today. 1 According to EPF this has resulted in 61 million members having less than RM 10000 currently in their savings and a staggering 79 of them having less than RM 1000 left consequently.

Click on Yes to sign the undertaking certificate. The Employees Provident Fund EPF has revealed full details for the i-Sinar program which will allow eligible members to make withdrawals from Account 1. The Finance Ministry has confirmed that the Employees Provident Fund EPF is working towards removing all conditions for the i-Sinar withdrawal.

KUALA LUMPUR April 1. EPF mmembers can mafe the withdrawal at httpspengeluarankhaskwspgovmy through the i-Account starting 1 April. The i-Sinar program was introduced to assist members who are affected by the current pandemic situation.

The Employees Provident Fund EPF suddenly becomes a familiar term even for the non-members when the governments effort in allowing the members to withdraw money from their accounts is. EPF members are allowed to withdraw a maximum amount of RM10000 and a minimum of RM50. Thursday 11 Feb 2021.

For those with RM100000 and below in Account 1 they can withdraw any amount up to RM10000. Finance Minister Tengku Zafrul Aziz stated in a written parliamentary reply that the EPF had liquidated assets in the. The Employees Provident Fund EPF did not.

August 2 2022. Affected members who wish to take out funds are able. In general the withdrawal will add liquidity to the countrys economy and this should give a boost to economic activities as Malaysians have a high tendency to spend Yesterday the EPF said it expects the i-Sinar facility to benefit two million eligible members with an estimated advance amount of RM14 billion to be made available.

1Withdraw 20k i-sinar 2Follow TS stock purchase recommendation 3Bursa open all in 4Google search top 10 places to 14th floor. This was done via the i-Lestari i-Sinar and i-Citra schemes which resulted in a total withdrawal of RM 101 billion by 74 million members. They have to withdraw from the savings balance in their Account 2 before accessing the savings in Account 1.

The Employees Provident Fund EPF has will open registrations for i-Sinar starting 21 December. Enter it and click on Verify. Finance minister Tengku Zafrul Aziz says EPF has sufficient assets to ensure funds are available for withdrawals and expenditures.

In the claim form under the section I Want To Apply For and select the claim you require ie. The payments will be staggered over a period of six 6 months with the first payment of up to RM10000. Youve heard the news - Employees Provident Fund EPF has allowed its contributors to withdraw money up to RM60000 from Account 1 via i-Sinar starting January 2021 - you can check via i-Account.

For further information members may contact the i-Sinar hotline at 03-8922 4848. Through the Employees Provident Funds EPF i-Sinar facility members can withdraw up to RM60000 from their Account 1. Last April the Employees Provident Fund EPF did not liquidate any specific asset to fund the i-Lestari i-Sinar and i-Citra schemes as well as the final one-time RM10000 special withdrawal facility.

I-Sinar 8 Other Things You Can Use Your EPF for.

I Sinar Category 2 How To Apply And Eligibility Comparehero

I Sinar Category 2 How To Apply And Eligibility Comparehero

I Sinar 8 Other Things You Can Use Your Epf For

Updated I Sinar Program Details Epf Members Can Start To Apply I Sinar Starting From 21 Dec 2020 News Puchong Co

I Sinar Epf Allows Account 1 Withdrawal Up To Rm60 000 Here S How Nestia

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

Epf I Sinar Akaun 1 Advance Facility What You Need To Know

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

The State Of The Nation Rm90 Bil I Sinar Withdrawal Changes Odds Of 5 Epf 2021 Dividend The Edge Markets

Bernama Epf Offers Further Details On I Sinar In Response To Media Query

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

Epf Announces Latest Details For Its I Sinar Withdrawal Facility

Epf Account 1 Withdrawal I Sinar The Pros And Cons

Epf I Sinar Applications Are Now Open For Category 1 Here S How To Apply

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

I Sinar Epf Allows Account 1 Withdrawal Up To Rm60 000 Here S How Trp

I Sinar Epf Allows Account 1 Withdrawal Up To Rm60 000 Here S How Trp

Epf Approves Rm19 62 Billion Worth I Sinar Applications Businesstoday